The Energy Theory of Everything

The importance of designing an energy market fit for net-zero.

A few years ago, writers at Works in Progress coined the phrase ‘The Housing Theory of Everything’. They proposed that every problem the western world was facing could be linked in some way to housing shortages, and the argument stands to reason - it can be argued that slow growth, climate change, poor health and economic inequality are all at least 2nd and 3rd order consequences of failing to build enough homes.

However, if we look further upstream I’d like to propose the real culprit is energy. The modern, industrialised society we know today was founded on the back of cheap, abundant energy which powered everything from the industrial revolution to mechanised agriculture, globalisation, and the creation of the welfare state. However we are now at an inflection point, where countries are deliberately choosing to constrain their energy supply as part of the very important transition to renewables.

And it’s these decisions, and the effect that they’re having on energy prices, which I see as the catalyst in what I will call The Energy Theory of Everything. High energy costs strangle investment, sap disposable income and generally counteract growth. The UK has been one of the first major economies to go all-in on the transition to renewables, and is therefore an important case study for the world to watch.

Renewables don’t have to be expensive - most logic would suggest that phasing out coal-fired power plants entirely and introducing vast swathes of renewables into the UK energy mix should bring down prices. There’s a bit of capital investment needed, but once set up and in the right conditions these wind and solar farms are producing an abundance of clean energy with very little day-to-day running costs. However, the average annual energy bill in the UK (inflation adjusted) is now twice as expensive as it would have been in 2008, and 50% more expensive than in 2020.

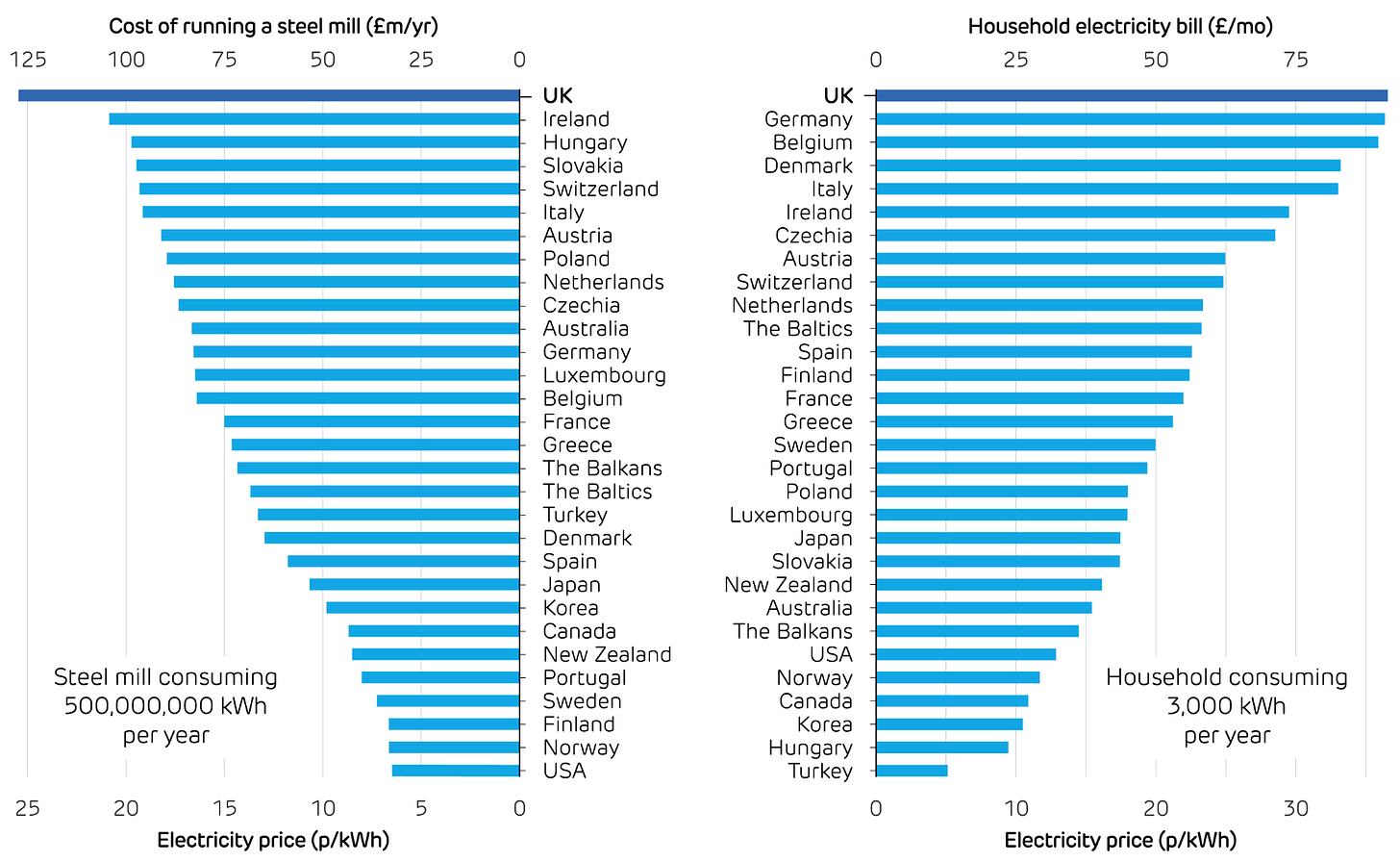

It’s now gotten to the point where the UK not only has the highest domestic energy bills in Europe, but industrial energy costs are 60% higher per unit of electricity than any other nation on the continent.

I’ll get onto why this is the case, and how we can bring things under control. But first, I think it’s important to return to the theory and highlight some of the more specific consequences of these prices.

Starting with industrial energy bills, these are considerably higher than domestic bills due to renewable obligation costs, feed-in tariffs and the climate change levy which combine to raise around £5.7bn each year and add an estimated 15% to industrial energy prices. The idea is to raise additional revenue over and above the base unit price to help fund net-zero investment, however when you are already starting with the most expensive energy in Europe or the G7, this doesn’t sit so well.

The result is that businesses of all sizes are struggling with their energy costs. The same costs that are currently strangling pubs and small businesses have already spelt the end for the UK steel and chemical industries. At a time where the government is talking about economic growth being the number one priority, and wanting the UK to be a market leader in AI and data centres - high energy costs continue to deter investment.

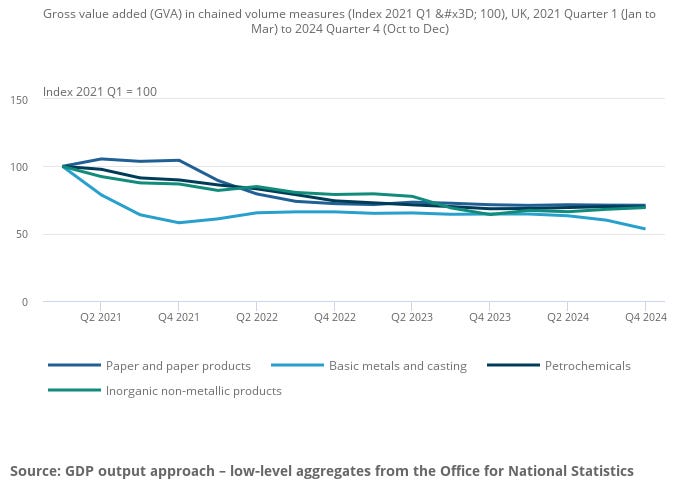

This isn’t just a warning of what might happen, it’s already begun. Between 2021 and 2024 industrial energy prices rose by 75%, while over the same period the real output of the UK's most energy-intensive manufacturing industries, like basic metals, paper, and chemicals, contracted by 33.6%, according to the Office for National Statistics. This isn't just a downturn, it's a hollowing out of the UK's industrial base.

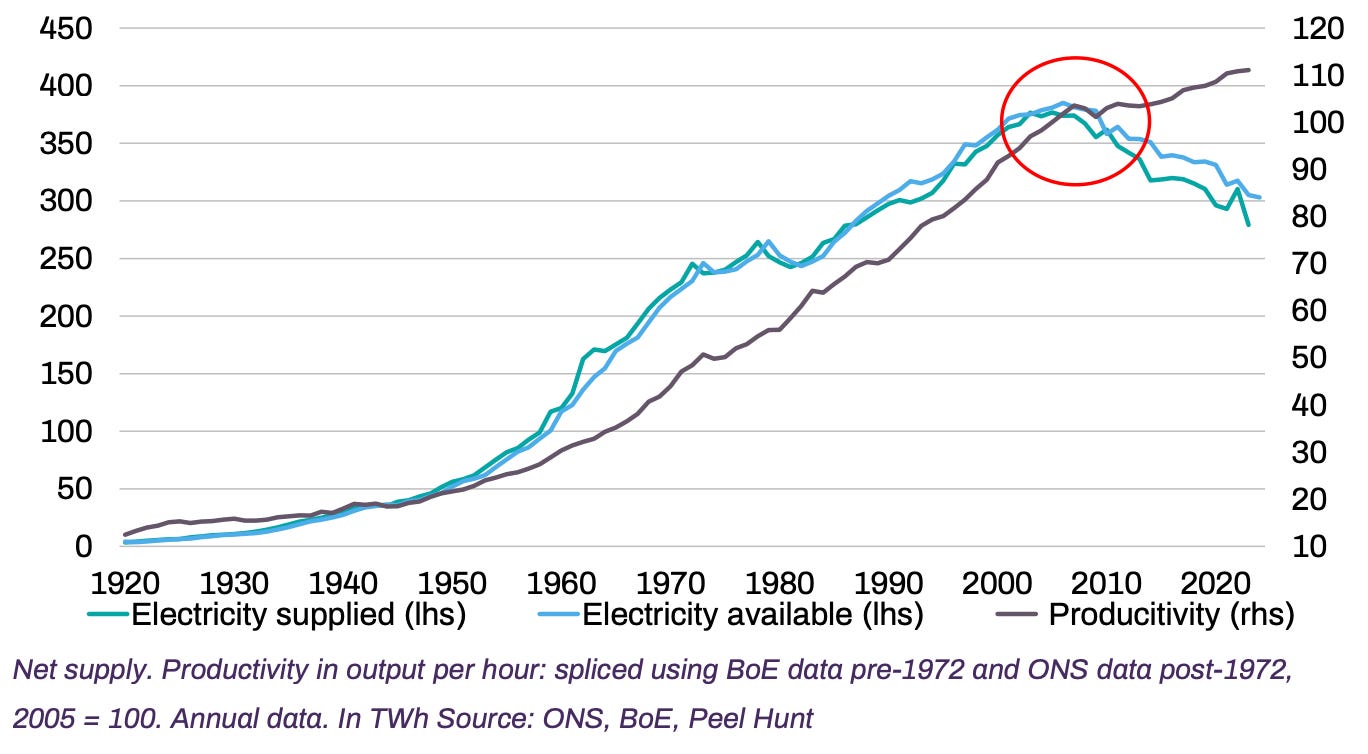

When analysing the UK economy, there is a clear point around 2008 where growth began to stagnate. If growth had continued at pre-2008 levels the UK GDP per person would have been almost 40% higher today. This is a point which not only correlates with the onset of the global financial crisis and the collapse of the pound, but also falls perfectly in line with the peak of UK energy supply.

While it would be an obvious stretch to hold falling energy supply accountable for all of the challenges faced in the UK since 2008, I strongly suspect it’s an under-appreciated aspect and a root cause behind many of the symptoms we see today.

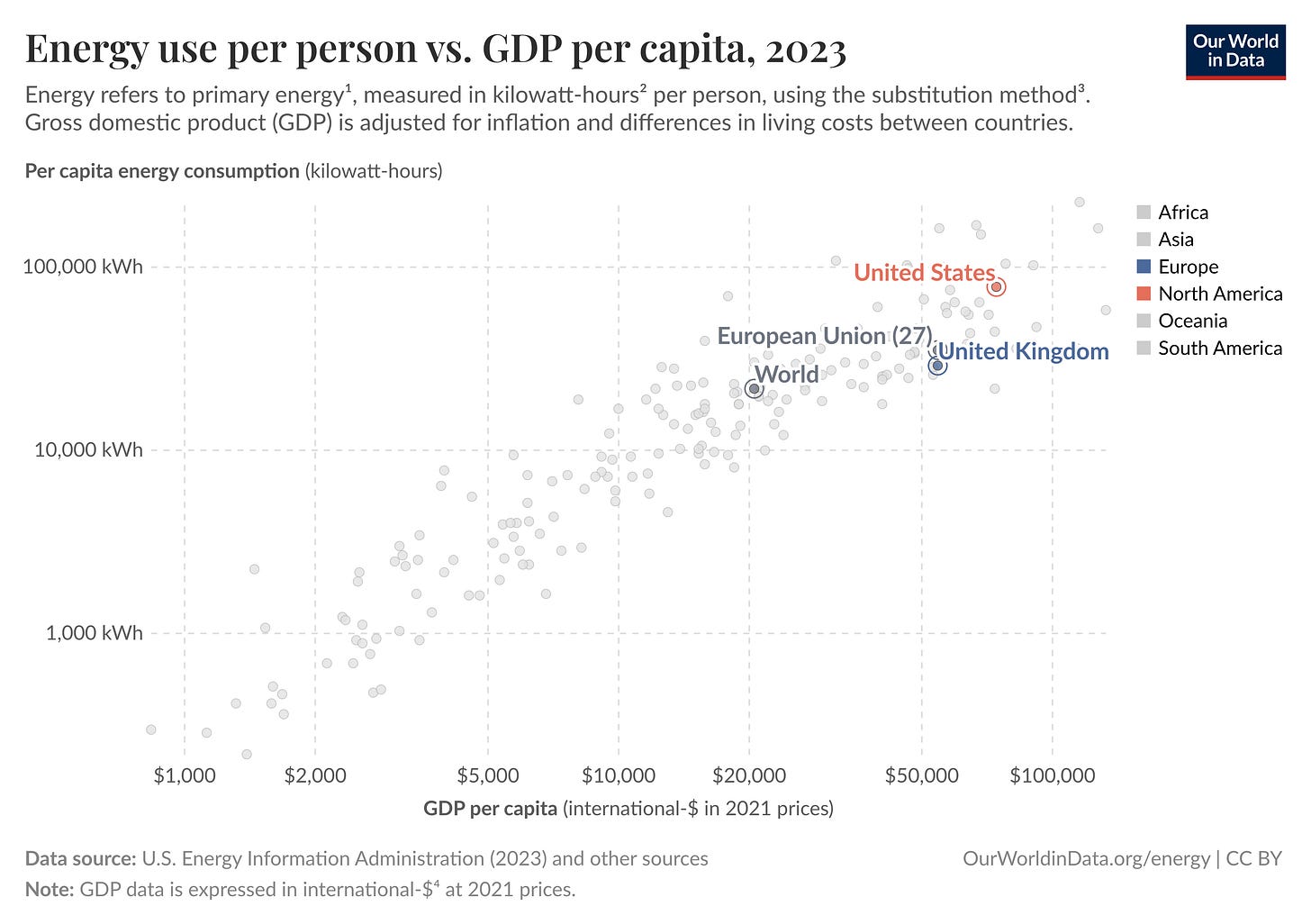

Looking at the graph below, we can see that energy consumption is a strong wealth indicator - put simply there are no rich countries with low energy consumption. When UK energy supply was at its peak around 2005, every person was consuming 45,000kWh per year, by 2023 that number had fallen 37% to just 28,500kWh per person. Not only has this shifted the UK downwards on this graph in terms of consumption, energy constraints and expense are almost definitely responsible for shifting us leftward in terms of where our GDP per capita could be.

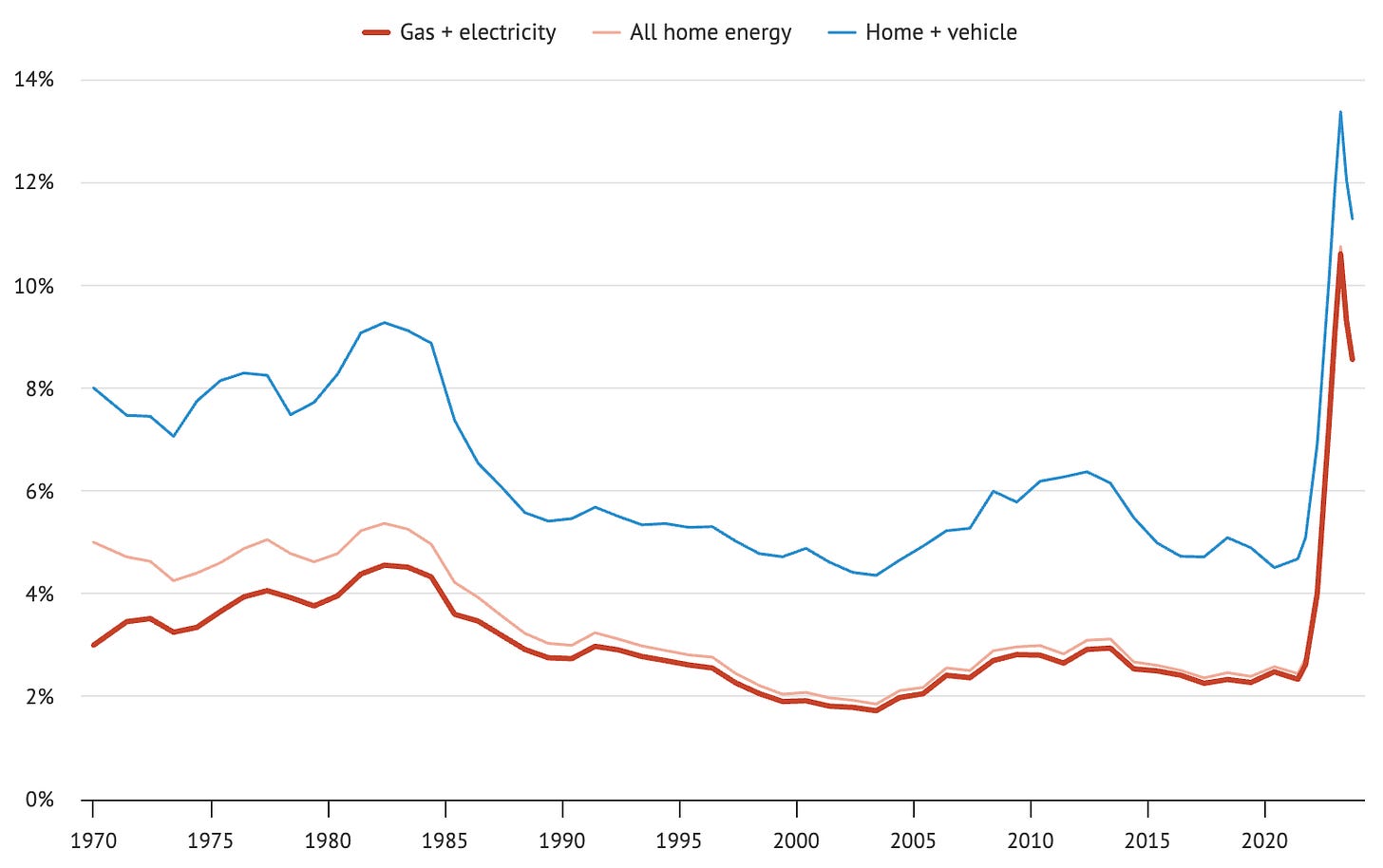

There are, of course, other consequences of high energy costs which perhaps hit closer to home than my growth arguments. National Energy Action now estimates that 6 million UK residents are unable to keep their homes warm at a reasonable cost without bringing their residual income below the poverty threshold. Energy costs have also been one of the largest drivers of inflation, which has spelt the end for near-zero interest rates. And as the graph below shows, it’s now soaking up more household income than at any point in the last 50 years.

The final consequence I want to discuss is political, if these consequences are seen as the cost of the transition to renewable energy, then others simply will not follow. Even in the UK, it’s become a heated debate with parties on the right wanting to row back on our net-zero commitments as the electorate begins to lose patience.

The current approach from the government has focused on targeted subsidies such as the warm homes discount, winter fuel payments and newly-announced “industry supercharger” policy which will exempt 7,000 energy-intensive businesses from the aforementioned levies, which account for roughly 15% of their energy bills.

The reality as I see it is that these sorts of “band-aid” policies do little to fix the underlying issues. Instead the government is spending tax revenue shielding small, specific groups from these underlying issues and further distorting the market.

The UK government does have a long term plan centred around improving grid infrastructure, investing in battery storage and increasing renewable capacity beyond even those 2005 peaks. The vast majority of current grid infrastructure was built between the 1950s and 1980s, and was designed for transmitting electricity from massive centralised fossil fuel power stations. Now that we’re moving towards decentralised and often offshore generation, we’ve been left with a grid full of bottlenecks.

It’s this which has led to the crazy stories you read of wind farms in Aberdeenshire being paid to turn off, while gas-fired stations are paid to turn on in the South of England. There simply isn’t enough capacity in the long-distance transmission lines to get this energy to where it is needed, and this results in the system operator having to pay constraint payments, which are expected to reach £1.8bn this year, to wind farms in return for them shutting off.

Investing in battery storage will also help alleviate the same problem. Currently our renewable generation is very weather dependent and spiky, the more battery storage gets brought online the easier it is to minimise wastage and the easier it gets to match demand to supply with renewables.

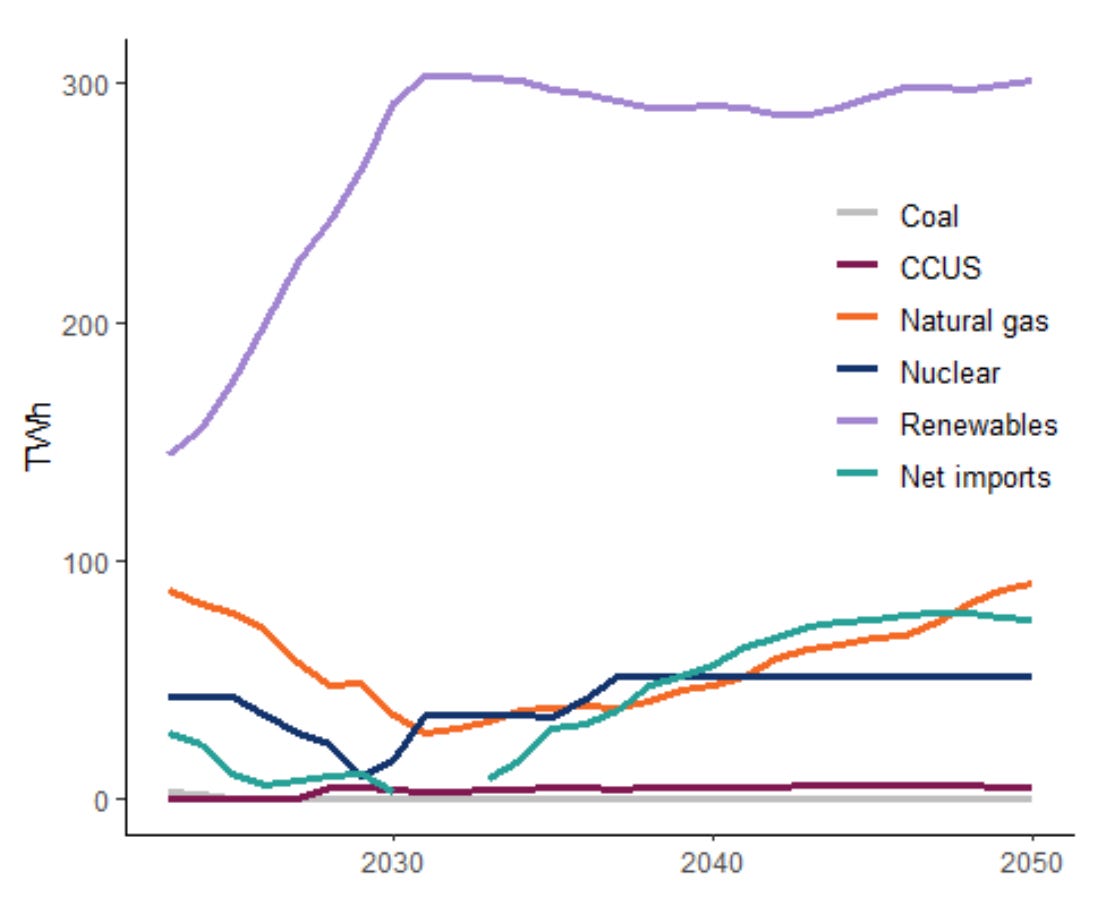

You can see how much this matters when you look at the government plans for future energy generation, below. The plan is to continue to take advantage of wind and solar, hopefully allowing us to return to running an energy surplus and taking advantage of new inter-connectors to sell excess energy across the continent. However, as we move in this direction the spiky-ness of the supply will only become more and more problematic making the role played by natural gas, nuclear and batteries in balancing out the grid at all times all the more important.

There’s a whole other article to be written about the betrayal of nuclear in this country. But for now it’s at least anticipated that Hinkley Point C and Sizewell C will come online at the beginning of the next decade - and we can only hope that the skills and knowledge relearned from these projects are not put to waste with another 30 year gap in nuclear projects. These power stations will provide the important base load which is currently provided by more expensive, and dirtier natural gas.

All of this is great for energy generation - which I’m convinced is on an upward trajectory at last. But it doesn’t yet answer the original question of how energy has become so much more expensive despite moving towards theoretically cheaper means of production. To answer this we need to look at how energy is sold on the wholesale market, which is frankly the whole the whole reason for writing this article in the first place.

The unit price paid for electricity is not simply the price it costs to generate it, instead it’s derived from a second-by-second auction on the UK’s wholesale electricity market. This market operates on a principle known as marginal cost pricing, a system that was designed for a fossil fuel era but is now creating these wild discrepancies between the all-time-low cost of generation and all-time-high unit costs paid in our increasingly green grid. While the unit cost paid on the market accounts for roughly 40% of a domestic energy bill, it is overwhelmingly responsible for the disconnect between our cheapening generation and soaring bills.

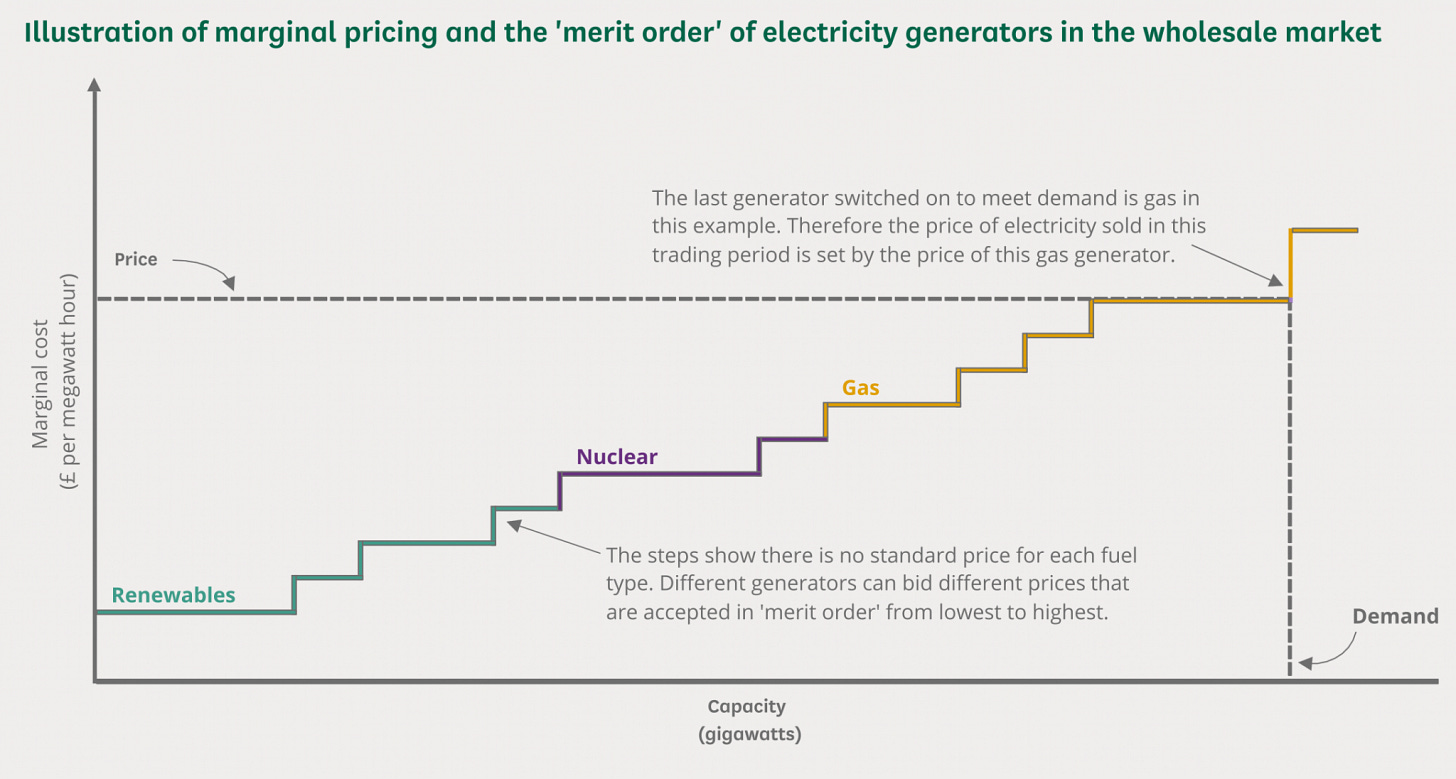

Energy is bought in ‘merit order’ which just means it is bought in a series of auctions, where the cheapest energy is always bought until you have enough supply to meet demand. However the price paid for all of this energy is always determined by the price paid for the final and most expensive unit of energy - the “marginal price” as shown in the diagram below.

It’s like going to a fruit market to buy 10 units of fruit, picking up 5 apples at 20p each (renewables), 4 oranges at 30p each (nuclear) and 1 pineapple for £1 (natural gas) - only because the pineapple is the marginal item, you have to pay the £1 each for all 10 items. It’s was, and still is, a common pricing system used to sell electricity across the world as it rewards efficiency and provides an incentive to be available at all times. If high prices were being paid, market signals would encourage others to open an efficient power plant and rake in the profits.

Traditionally the cost differences between different fossil fuel sources was far smaller than they are now that cheap renewables are online, and supply was nowhere near as spiky as it has become. However we made a conscious policy decision that we are going to “top up” the grid using gas-fired plants, which fill these spikes and match supply to demand, meaning that for 98% of the time all UK energy is being bought based upon the cost of natural gas on international markets.

This isn’t the complete story, as solar and wind farm developments of the last 10 years have begun signing what is known as Contracts for Difference (CfD), a system that guarantees a strike price that they can sell energy at which is usually below the marginal rate but guarantees them a predictable profit and helps them secure financing for the initial investment.

So while all energy is initially sold at the marginal rate (dictated by natural gas 98% of the time in the UK), the renewables firms then have to refund the difference between this and the strike price agreed in the CfD, to a government body. This money is then held in a fund, which if positive helps to reduce the “policy costs” which is lumped onto your energy bill - usually accounting for around 15% of the total.

Getting slightly more technical, there are two types of gas-fired plants used in the UK. Combined Cycle Power Plants are built for efficiency, burning gas in a turbine to generate electricity, then capturing the hot waste gas from that process to boil water and drive a second steam turbine. Whereas Single Cycle Plants lack this second turbine, reducing thermal efficiency by around 30% but allowing them to fire-up much faster and making them the preferred choice for filling demand, particularly in the evenings as solar supply drops off but demand remains high.

The irony is that these less efficient (and more expensive) single cycle plants are becoming more common due to their flexibility, meaning that in the last 20 years we’ve not only moved away from a wholesale market which incentivised cheap generation, but we’ve even managed to make the gas-fired power more expensive as well! Bundle in the increases in network and operating costs which together can make up to 40% of a domestic energy bill and help pay for the aforementioned grid infrastructure upgrades and you can begin to see how UK energy costs have begun to spiral.

Luckily, there are at least some people in Whitehall who recognise this is a major issue and the government is conducting what it calls the Review of Electricity Market Arrangements (REMA). The fundamental goal of REMA is to replace the current energy market with a new system which is fit for net-zero and permanently decouples the price of renewables from the price of natural gas.

The review began in 2022 under the previous government, after the Russian invasion of Ukraine and subsequent natural gas price rises had exposed these flaws in the current system. Three years into the review and the most disruptive proposals, have been ruled out, with it currently looking as though the decision is between expanding the CfD system already used for most renewable projects or moving towards a zonal pricing system.

Personally, if we’re going to keep this energy mix then I’d have liked to see us split the market entirely into a “green pool” and a “fossil fuel pool” each with their own marginal pricing system however this was determined to be too disruptive and not as effective at encouraging renewable investment as the current CfD system - which looks as though it’s here to stay. I’m not going to get too invested in this article looking at solutions which aren’t on the table any more, instead let’s look at the two remaining options that the government are expected to choose between before the end of this year.

“Reformed National Pricing” is the evolutionary option that would maintain a single national wholesale price for the UK but introduce significant reforms to what are known as the Transmission Network Use of System (TNUoS) charges as well as changes to the balancing arrangements. These idea behind these changes is that by continuing the current CfD arrangement while altering the market incentives they can continue to encourage investment, but better focused in areas with additional network capacity which would help to reduce infrastructure costs.

It’s an evolutionary step, and in my mind it is still a band-aid over the current marginal system to force it to work for renewables. The explicit marginal price will still be overwhelmingly set by gas at least until renewable supply far out-matches demand. This means that it would still be down to government, through the independent body that issues the CfD, to collect (or pay) the difference between the negotiated CfD strike price, and market marginal price in what feels like a very convoluted approach to buying electricity in a net-zero world.

The other proposal under consideration is zonal pricing, which would replace the current single national price with different wholesale prices in different geographical zones of the UK. The idea here is to try and make the price of energy in each zone reflect the supply on the network in these areas, encouraging energy-intensive industries to move to areas with excess supply (i.e. Scotland) and investors to fund renewables in high-demand areas (i.e. South of England).

This is my preferred option among those still on the table, while there is still some debate over how much they are willing to allow domestic prices to vary between regions (for political reasons…) this solution would at least bring down average energy costs across the country further than the reformed national pricing. Incentivising usage in areas with excess supply would eliminate the ridiculous situations where wind farms are being paid to turn off up north, only to pay again for gas-fired plants to turn on down south. But beyond just this, incentivising usage near-supply is inherently more efficient and a better use of transmission capacity which will bring down the network costs for everyone no matter where in the country they are.

Zonal pricing is also the best-placed proposal to offer genuinely cheap energy in some areas for industry, which would be a massive step forward given how uncompetitive the UK has become for energy-intensive industries. You only need to look at the Nordic electricity market to see how well this could work.

For decades the national grids of Norway, Sweden, Finland, and Denmark have been pooled together into a combined zonal pricing system, with the market divided based on constraints in the transmission network. This system has been very effective at managing grid congestion, allowing cheap, clean electricity to flow efficiently from the hydro-rich and windy areas in the north to the more populous and industrialised south. Cheap energy in the north has helped Sweden become a leader in green steel production, an incredibly energy-intensive industry, and more recently companies like Meta have been investing in data centres in the region.

If we can follow suit and reform our energy market to take advantage of our geography, and our early transition to renewables then perhaps the Energy Theory of Everything comes back into play. If the cost and availability of energy really is the fundamental driver of economic prosperity, then the REMA represents a rare opportunity to correct costly years of poor planning and decision making.

If we get it wrong, and bills continue to diverge from the cost of generation, then not only will public sentiment in the UK turn on net-zero, but worldwide countries will look with fear that this is the price of standing up for the climate.